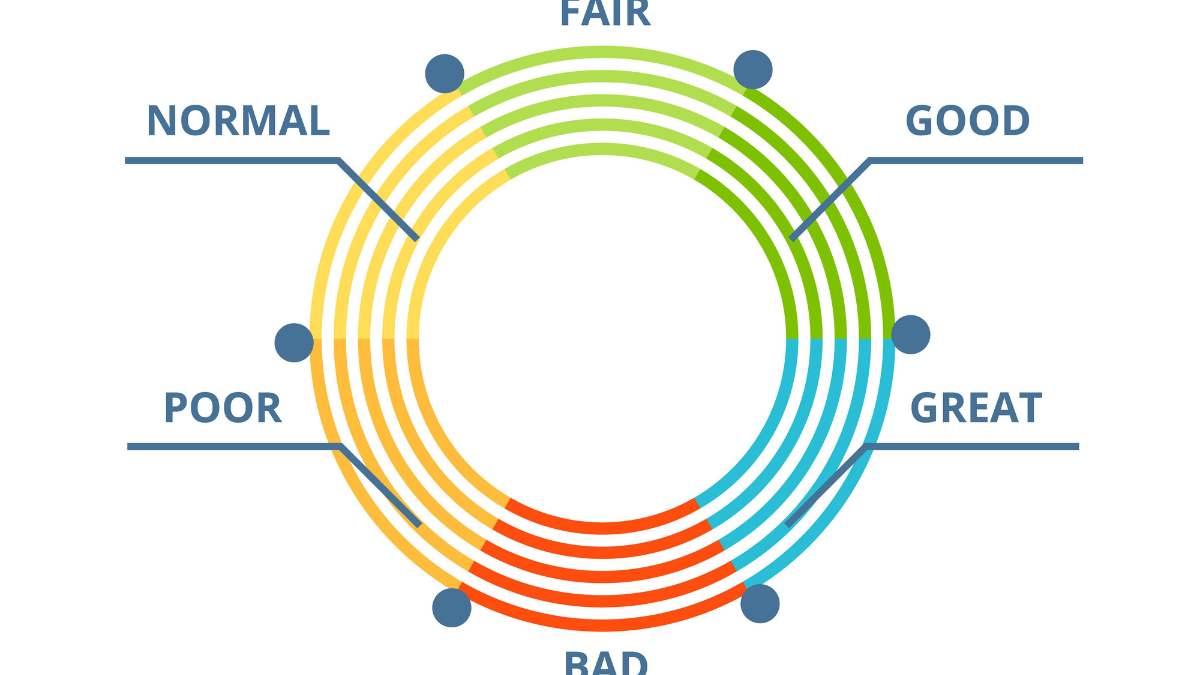

Further developing your FICO rating is an urgent step towards accomplishing independence from the rat race. Whether you’re intending to purchase a home, apply for an advance, or get better loan fees, major areas of strength for a score opens ways to different monetary open doors. In this blog, I will share useful hints and significant stages on the most proficient method to further develop your FICO assessment successfully. Take charge of your financial future and embark on this journey with me.

1. Understanding Your Ongoing Credit Standing

Prior to plunging into credit improvement procedures, it’s fundamental to comprehend your ongoing credit standing. Get a free credit report from legitimate acknowledged departments, like Equifax, Experian, or TransUnion.

Description:

– Break down your credit report to recognize any mistakes or blunders that could be adversely affecting your score.

– Search for late installments, remarkable obligations, and whatever other variables that might be hauling down your FICO rating.

– Routinely checking your credit report guarantees you know about any progressions and can make a brief move to redress issues.

2. Taking care of Bills On Time, Like clockwork

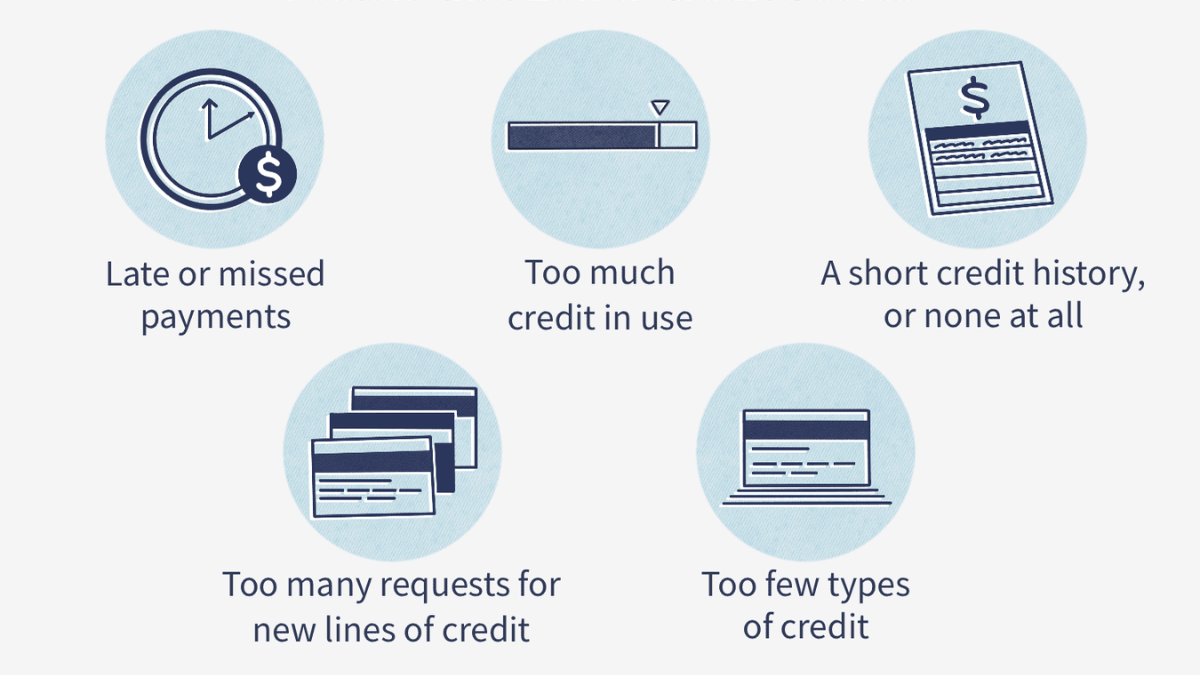

Perhaps the most pivotal variable influencing your FICO rating is your installment history. Reliably covering your bills on time exhibits dependable monetary way of behaving.

Description:

– To make sure you never miss a payment, set up reminders or set up automatic payments.

– Pay essentially the base sum expected on the entirety of your credit accounts.

Paying your bills on time improves your creditworthiness and raises your credit score.

3. Diminishing Visa Adjusts

High Visa adjusts can adversely affect your credit use proportion, which is the level of accessible credit you are utilizing.

Description:

– Plan to keep your credit usage underneath 30% of your absolute credit limit.

– Consider paying more than the base due every month to diminish Mastercard adjusts quicker.

– Bringing down Mastercard adjusts exhibits capable credit the executives and decidedly influences your FICO rating.

4. Staying away from New Credit Applications

Applying for different new credit accounts inside a brief period can flag monetary misery to banks and may bring down your FICO rating.

Description:

– Limit new credit applications except if totally fundamental.

Your credit score may be temporarily affected by each credit inquiry made by potential lenders.

– Only apply for credit when you absolutely need it, and be strategic when opening new credit accounts.

5. Keeping Old Records Open

The length of your record of loan repayment assumes a part in deciding your FICO rating. Keeping old credit accounts open can emphatically influence your financial assessment.

Description:

– Try not to close old charge cards, particularly those with a long and positive record of loan repayment.

– A more extended record of loan repayment shows your capacity to capably oversee credit.

– Keeping a blend of old and new credit records can further develop your FICO rating after some time.

6. Questioning Wrong Data

Assuming you spot mistakes or blunders on your credit report, make a prompt move to debate them with the credit departments.

Description:

– Contact the credit agencies to report any mistakes you find on your credit report.

– Give supporting documentation to back up your debate.

– The evacuation of incorrect data can help your FICO assessment fundamentally.

7. Turning into an Approved Client

Ask a companion or relative with a solid financial record to add you as an approved client on their Visa.

Description:

– As an approved client, you benefit from the positive record of loan repayment related with the card.

Before authorizing a user, verify that the primary cardholder maintains excellent credit habits.

– This methodology can help you lay out or further develop your FICO rating.

Conclusion:

Further developing your FICO rating is an excursion that requires tolerance and determination, yet the prizes are worth the effort. By understanding your ongoing credit standing, covering bills on time, lessening Visa adjusts, staying away from pointless credit applications, and keeping old records open, you can gain critical headway towards a higher FICO rating. Your creditworthiness can also be improved by disputing incorrect information and becoming an authorized user. Keep in mind that over time, even minor changes can result in significant enhancements. Follow these easy steps to take control of your finances and watch your credit score rise, paving the way for better financial opportunities.